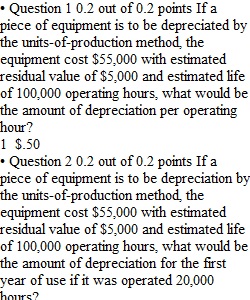

Q • Question 1 0.2 out of 0.2 points If a piece of equipment is to be depreciated by the units-of-production method, the equipment cost $55,000 with estimated residual value of $5,000 and estimated life of 100,000 operating hours, what would be the amount of depreciation per operating hour? • Question 2 0.2 out of 0.2 points If a piece of equipment is to be depreciation by the units-of-production method, the equipment cost $55,000 with estimated residual value of $5,000 and estimated life of 100,000 operating hours, what would be the amount of depreciation for the first year of use if it was operated 20,000 hours? • Question 3 0.2 out of 0.2 points If a piece of equipment bought on November 1 20Y1 is to be depreciation by the units-of-production method, the equipment cost $55,000 with estimated residual value of $5,000 and estimated life of 100,000 operating hours, what would be the amount of depreciation for the first year of use if it was operated 2,000 hours? • Question 4 0.2 out of 0.2 points In the journal entry to record depreciation for store equipment, what account is debited? • Question 5 0.2 out of 0.2 points In the journal entry to record depreciation for store equipment, what account is credited?

View Related Questions